Present classes

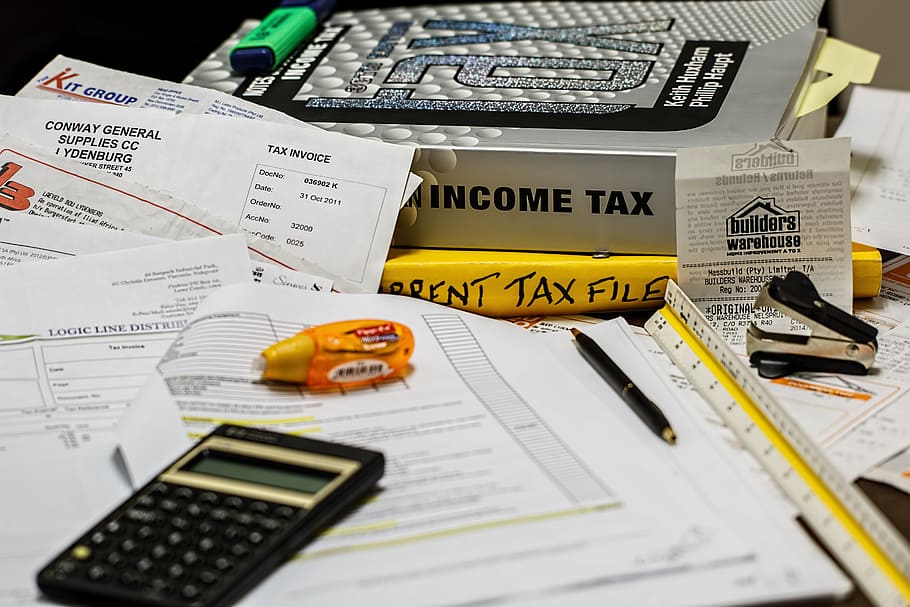

Discover the Taxation Course

Beginner to advanced Level

Why?

Want to understand taxes, stay compliant, and make smarter financial decisions — without getting lost in complex rules and jargon?

This beginner-friendly course shows you how to manage taxation effectively from the ground up.

You’ll learn how to understand key tax concepts, calculate liabilities, prepare returns, claim deductions, and keep accurate records — whether you’re running a small business, handling personal finances, or working in accounting.

No prior tax knowledge needed — just clear, practical steps to build a confident, organized, and compliant approach to managing taxes that actually works.

- ✅ Free Course Materials

- ✅ Free trial session

- ✅ Learn at your own pace, anytime, anywhere

- ✅ Lifetime access to the full course

- ✅ Attendance Certificate

- ✅ Support via WhatsApp

- ✅ Course updates included

How it works:

1- Enroll by pressing on: “Save your spot now”

2- Fill the form and we will contact you via WhatsApp

3- Get full access to the platform and video lessons

4- Watch and practice at your own pace

5- Schedule your 1-on-1 session anytime

6- Chat with your teacher on WhatsApp if you need support

This course is for you if..:

- You’re a beginner with zero or limited experience in taxation, financial compliance, or preparing tax returns.

- You want to understand how proper tax management can help you stay compliant, reduce liabilities, and make smarter financial decisions — even without a background in accounting or finance.

- You’re curious how to grasp key tax concepts, calculate what you owe, prepare and file returns, claim deductions legally, and keep accurate records — whether for a small business, personal finances, or an organization.

- You’ve seen others handle their taxes with ease and confidence and thought, “How do they make it seem so straightforward?” — and want a step-by-step course to help you do the same.

- You’re looking for a beginner-friendly guide with real examples and practical tools — to help you save time, avoid costly mistakes, and manage taxes in an organized, compliant, and stress-free way.

Course Highlights:

- Introduction to Taxation — For Beginners

- Understand how effective tax management helps you stay compliant, reduce liabilities, and make informed financial decisions — and how you can master the essentials even with zero prior experience.

- Learn how to grasp key tax concepts, calculate liabilities, prepare and file returns, claim deductions legally, and maintain accurate records — whether you’re managing a small business, handling personal finances, or working in accounting.

- Explore how organized tax practices can save time, prevent costly mistakes, and improve financial stability — with clear explanations and practical tools anyone can follow.

- Follow guided lessons with real examples, ready-to-use templates, and step-by-step activities — helping you manage taxes confidently, efficiently, and compliantly.

Plans

🔴Plan: Guided Version

$69

✓ Lifetime access to the full course

✓ Learn at your own pace, anytime, anywhere

✓ Attendance Certificate

✓ Free Course Materials

✓ Designed Learning Path

✓ Interactive learning elements (quizzes/tasks)

Leave a comment